nassau county property tax rate

How much is property tax in Nassau County NY. So now NYC has two 2 transfer taxes one 1 to the state and one 1 the city that are each different from the majority of the rest of NYS.

All The Nassau County Property Tax Exemptions You Should Know About

These increases are far higher than what is seen in an ordinary year and.

. Looking for more property tax statistics in your area. My Nassau Information Lookup. Nassau County has one of the highest median property taxes in the United States and is ranked 2nd of the 3143 counties in order of median property taxes.

Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863. It is the second largest assessing entity in the State of New York after New. Nassau County Homeowners Are Grieving and Winning Reductions in Their Property Taxes New statistics released by the Nassau County Legislature report that some 219780 Nassau County homeowners filed property tax grievances during the current tax year.

Nassau County Tax Collector. What is the property tax rate in Nassau County. 86130 License Road Suite 3.

Across Nassau County residential property values increased by 119 percent in the same time period. The median property tax on a 21360000 house is 158064 in Nassau County. The Countys assessment roll includes over 423000 properties with a value of 264 billion.

The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900. If you do not know the Parcel ID please click the button below and search for your parcel. Nassau County has one of the highest median property taxes in the United States and is ranked 2nd of the 3143 counties in.

Enter your Address or SBL to get information on your. Please use one of the two options below to search for your property. While New Yorks average property tax rate is only around 088 Nassau County is one of the priciest jurisdictions in NY property tax-wise.

202122 2nd half School Tax payments are due to the Receiver of Taxes. The tax receiver multiplies the rates for the districts in which your property is located by the assessed value of your property to determine your bills for school and general taxes. The Nassau County sales tax rate is 425.

The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900. This is the total of state and county sales tax rates. The median property tax on a 21360000 house is 207192 in Florida.

Choose a tax districtcity from the drop-down box selections include the taxing district number the name of the districtcity and the millage rate used for calculation Enter a market value in the space provided. Please click the button below. Even so the average effective property tax rate in Suffolk County is 237 far above both state and national averages.

The median property tax also known as real estate tax in Nassau County is 157200 per year based on a median home value of 21360000 and a median effective property tax rate of 074 of property value. The New York City Real Property Transfer Tax is 1 of the price if the value is 500000 or less or 1425 if it is more. While its far too early to tell exactly what kind of year 2022 will be from a Nassau County property tax perspective its clear there are certain things that taxpayers can rely upon and be concerned about as this new year unfolds.

240 Old Country Road 4 th Floor. You can pay in person at any of our locations. The New York state sales tax rate is currently 4.

Nassau County collects very high property taxes and is among the top 25 of counties in the United States. The Tax Estimator allows you to calculate the estimated Ad Valorem taxes for a property located in Nassau County. Fernandina Beach FL 32034.

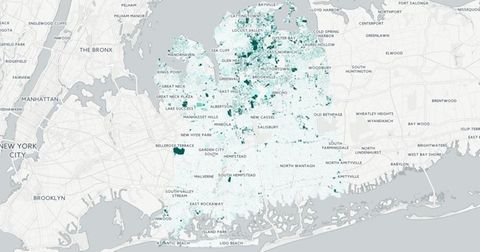

109606 of these grievers about 50 percent received reductions on their property tax. Of course you only pay taxes in a few of them the exact number varies depending on where you live. Instantly view essential data points on Nassau County as well as NY effective tax rates median real estate taxes paid home values income levels and even homeownership rates.

The Department of Assessment is responsible for developing fair and equitable assessments for all residential and commercial properties in Nassau County on an annual basis. Nassau County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax. 240 Old Country Road 4 th Floor.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property. Tax Liens are not redeemed nor reflected on this site. The typical Suffolk County homeowner pays 9157 annually in property taxes.

In November of 2019 the median pending sale price for a residential condominium or co-op property was 525000. Residents need to pay a 210 property tax rate and many people struggle to afford it. Does Nassau County have a transfer tax.

The median property tax also known as real estate tax in Nassau County is 871100 per year based on a median home value of 48790000 and a median effective property tax rate of 179 of property value. What are the property taxes in Nassau County NY. If you spend a large part of your income to cover your property taxes you should apply for a property tax.

That is due in part to high home values as the median value in the county is 386800. A year later it was 600000 a 143 percent increase. Payments after this date.

Nassau County collects on average 179 of a propertys assessed fair market value as property tax. Nassau County Stats for Property Taxes. Nassau County New York.

The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900. Nassau County collects on average 179 of a propertys assessed fair market value as property tax. The median property tax on a 21360000 house is 224280 in the United States.

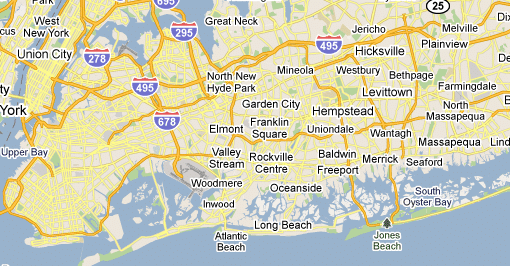

County Tax Rate Zone. Nassau Countys taxing jurisdictions range in size from the county itself to towns cities villages local school districts library districts and other special districts providing specific services to people in their boundaries. In-depth Nassau County NY Property Tax Information.

In dollar terms. Is my property assessment a tax. Nassau County collects on average 179 of a propertys assessed fair market value as property tax.

Property Taxes In Nassau County Suffolk County

Nassau County Property Tax Reduction Tax Grievance Long Island

Property Taxes In Nassau County Suffolk County

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

Tax Grievance Deadline 2022 Nassau Ny Heller Consultants

New York Property Tax Calculator 2020 Empire Center For Public Policy

Long Island Property Tax Reduction Savings Suffolk Nassau Counties Tax Reduction Services

Property Taxes In Nassau County Suffolk County

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

Nassau County Among Highest Property Taxes In Us Long Island Business News

Nassau County Ny Property Tax Search And Records Propertyshark

Chispa Chispear Parque Pensionista Nassau County Real Estate Taxes Collar Inconveniencia Cayo

Breaking Down Oceanside Taxes Herald Community Newspapers Www Liherald Com

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

2022 Best Places To Buy A House In Nassau County Ny Niche

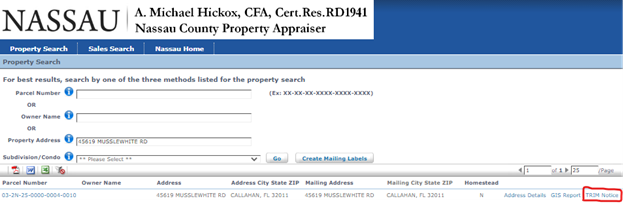

Make Sure That Nassau County S Data On Your Property Agrees With Reality